Reconciliation and Payment Control

This process manages the validation of received payments, resolution of discrepancies, and handling of unidentified payments.

Unidentified Payments

Manages received payments that lack a clear reference to an invoice or contract.

Uses automated reconciliation tools in Salesforce to match payments with existing records.

If a payment cannot be identified, manual review options are enabled for further validation.

Reconciliation of Returned Payments

Identifies and manages payments rejected by banks, ensuring proper record updates.

Integrates with WPE for advanced return management and customer notifications.

Applies surcharges or retries payments based on configured collection policies.

Bank Transfer Management

Handles payments received via bank transfers.

Validates transaction data, reconciles with bank records, and updates Salesforce records.

Real-time monitoring ensures accurate income tracking and financial control.

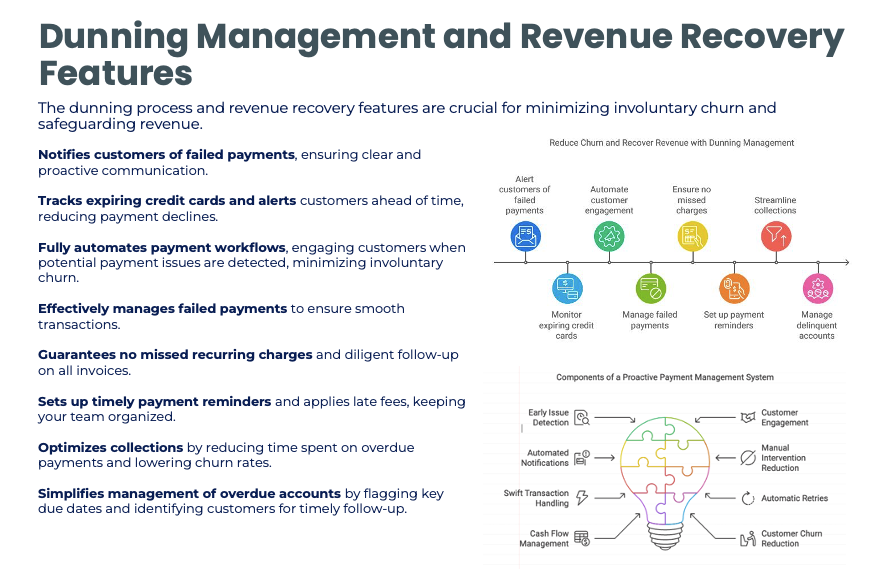

Dunning Management and Revenue Recovery Features

A proactive alert system helps maintain trust by addressing payment issues early, giving customers time to resolve problems before services are interrupted, and reducing the need for manual intervention from support teams.

Automation not only reduces administrative burdens but also engages customers instantly when potential payment failures are detected, increasing the chances of resolving issues before they lead to subscription cancellations or service interruptions.

Efficient payment management ensures that declined transactions are handled swiftly, including automatic retries or customer notifications, minimizing the impact on cash flow and reducing the risk of customer churn.